st louis county personal property tax calculator

Additional methods of paying property taxes can be found at. Department of Revenue Appointments.

Amazon Com St Louis County Missouri Zip Codes 36 X 48 Laminated Wall Map Office Products

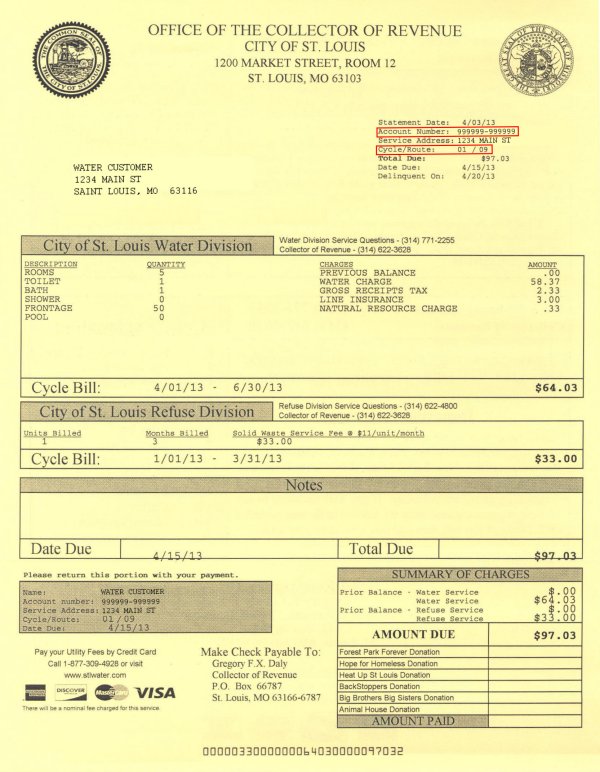

Paying Property Taxes with Debit Cards or Credit Cards All payments are processed through Official Payments Corp.

. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in St. Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st. We look forward to serving you.

City Hall Room 109. Louis County Missouri - St. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in St.

When you click on the logo for your payment type you will be directed to the Parcel Tax Lookup screen. You pay tax on the sale price of the unit less any trade-in or rebate. The median property tax on a 17930000 house is 163163 in Missouri.

All Personal Property Tax payments are due by December 31st of each year. Pay your personal property taxes online. Department of Revenue Appointments.

Assessor - Personal Property Assessment and RecordsAssessor - Real Estate Assessment and AppraisalAssessor - Real Estate Records Summary Provides formulas used to calculate personal property residential real property and commercial real property. Louis county residents amounts to about 313 of their yearly income. You can search and find the latest reports from the Auditors Office.

Personal Property Tax Declaration forms must be filed with the Assessors Office by April 1st of each year. All Personal Property Tax payments are due by December 31st of each year. Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st.

The median property tax on a 14040000 house is 147420 in the United States. November 15th - 2nd Half Agricultural Property Taxes are due. Personal Property Tax Department.

Motor Vehicle Trailer ATV and Watercraft Tax Calculator. 636-949-7435 Hours Monday - Friday 8 am. Locate print and download a copy of your marriage license.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in St. The countys average effective property tax rate is 138 well above both state and national averages. Louis county is 223800 per year based on a median home value of 17930000 and a median effective property tax rate of 125 of property value.

You can pay your current year and past years as well. For your convenience we present the latest documents from our central document library. The median property tax on a 19730000 house is 207165 in the United States.

Subtract these values if any from the sale. Louis MO 63103 314 622-4181 Monday-Friday 800 am-500 pm Assessing Personal Property Tax. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date.

If your taxes are delinquent you will need to contact the County Auditor. Want to learn more about your mortgage payments. Its quick and easy.

Leave this field blank. The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes. Louis County Assessors Office is responsible for accurately classifying and valuing all property in a uniform manner.

To declare your personal property declare online by April 1st or download the printable forms. Charles MO 63301 Email Ph. Property 1 days ago Personal Property Tax Declaration forms must be filed with the Assessors Office by April 1st of each year.

November through December 31st you may also drop off your payment in the night deposit box at one of four Commerce Bank locations. The median property tax on a 17930000 house is 188265 in the United States. Scott Shipman County Assessor 201 N.

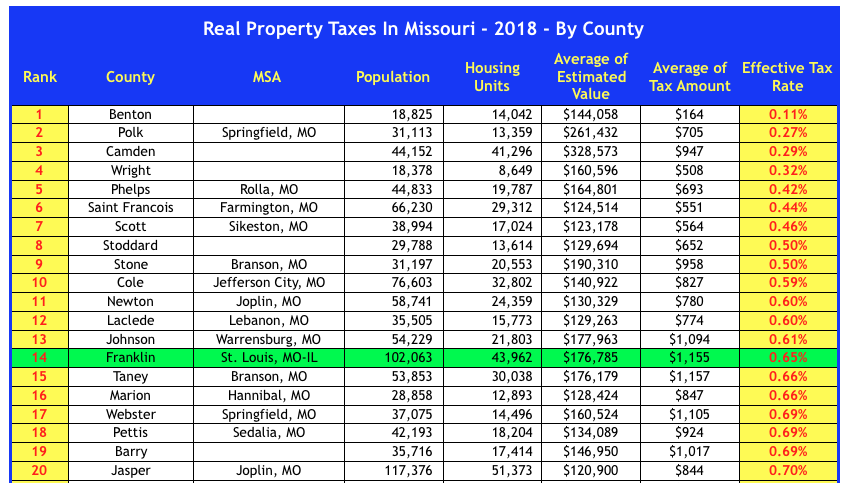

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. All Personal Property Tax payments are due by December 31st of each year. Louis County has the highest property tax rate of any county in Missouri.

Your feedback was not sent. Actual property tax assessments depend on a number of variables. Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes.

If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. Search All Property Tax Reports and Related Documents. The median property tax in St.

Monday - Friday 800am - 500pm. Pay your current or past real estate taxes online. Personal Property Tax Department - St.

Louis County Personal Property Tax. Place funds in for an inmate in the St. Home Motor Vehicle Sales Tax Calculator.

Personal property declaration info examples of tangible personal property tax rates and more 1200 Market St Rm 115-117 St. We are committed to treating every property owner fairly and to providing clear accurate and timely information. Louis County Missouri is 2238 per year for a home worth the median value of 179300.

If you are paying prior year taxes you must call 218 726-2383 for a payoff amount. To view past reports select Include Archive Items. For additional information click on the links below.

Louis County collects on average 125 of a propertys assessed fair market value as property tax. Louis County Missouri is 2238 per year for a home worth the median value of 179300. Check out our mortgage payment calculator.

Actual property tax assessments depend on a number of variables. Missouris most populous county St. Mail payment and Property Tax Statement coupon to.

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Revenue St Louis County Website

St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News

Online Payments And Forms St Louis County Website

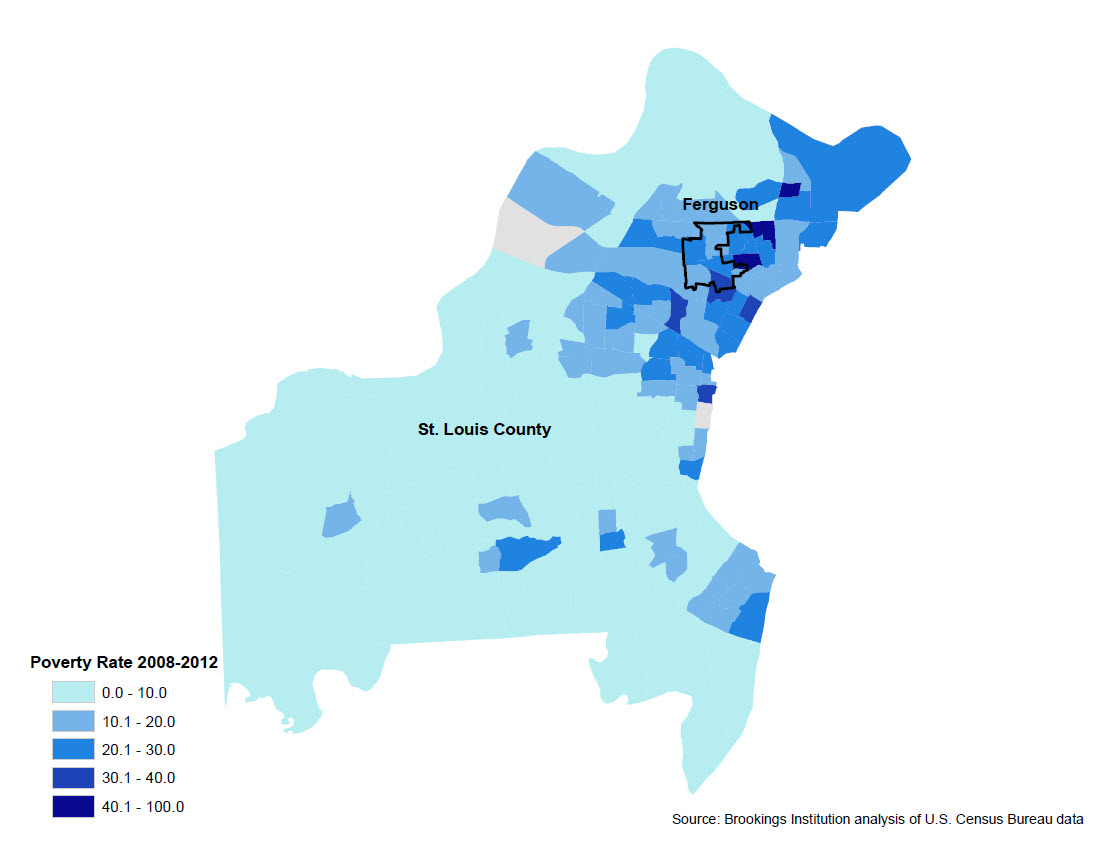

Ferguson Mo Emblematic Of Growing Suburban Poverty

Collector Of Revenue Faqs St Louis County Website

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

County Assessor St Louis County Website

Hennepin County Mn Property Tax Calculator Smartasset

Collector Of Revenue St Louis County Website

Missouri Property Tax Calculator Smartasset

County Assessor St Louis County Website

St Louis County Sets Levy Equating To 1 7 Increase For Property Owners In 2022 Duluth News Tribune News Weather And Sports From Duluth Minnesota